Financial Inflection Point Imminent

- Rohan Clugston

- Apr 11, 2021

- 3 min read

If Austin Powers is to be believed, the 1970s was a ‘groovy’ era known for flared pants, disco music, and free love. During this decade the average annual salary of a man in the United States was approximately $8,000, and he could deposit his saving in a bank to earn ~10% interest.

Assuming this disco bopping man (and his family) consumed 80% of his salary, he could save $1,600 per year which, after 20 years compounding interest, provided him with savings over $100,000.

Thus, after 20 years of working hard, a man in the 70s could retire and live a comfortable life solely on the interest from his savings (10% of $100,000 = $10,000 per year), preserving his capital for future generations.

Preservation of capital was much easier in the 1970s with higher interest rates.

We now jump in Austin Power’s time machine to fast forward 50 years and compare with a man (or women) working in the United States today. Here we find the equation is completely different, with capital preservation practically impossible.

Today the average worker in the United States earns $50,000 per year, and they are lucky to receive 1% interest on savings. Using the same mathematics, they now need to save $5 million to retire and live solely off interest. Assuming today’s worker also saves 20% of their salary, it would take 180 years to save this amount!

As such, people today cannot live solely off the yields of their capital (interest, rent, or dividends), and are instead forced to consume their capital upon retirement.

The incredibly low yields on capital are forcing everyone to speculate on risky assets, chasing capital gains as compensation. This is driving the prices of all assets (stocks, real estate, commodities, and cryptocurrencies) through the roof, and making everyone feel wealthy in the process.

Thus we are witnessing a scenario where the wealth of developed nations appears to be increasing with rising asset prices, when instead the nations are becoming poorer via the consumption of capital.

Much of the consumed capital isn’t indeed lost, it is simply transferred from a seller to a buyer. So who is the net-buyer of capital if developed nations are currently net-sellers? The unsurprising answer is: developing nations.

Developing nations have been manufacturing nearly all goods consumed by the United States for the past few decades, and they receive payments in US dollars. Developing nations are using these dollars to purchase the capital which is currently being offloaded.

We see this with China’s Belt and Road initiative, and the rapid purchasing of American real estate, farms, mines, and corporations.

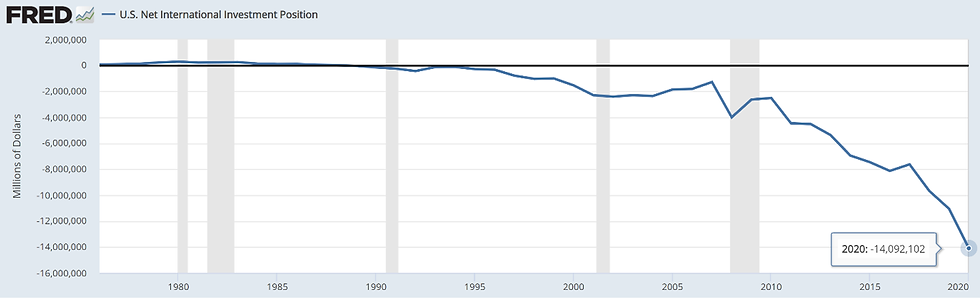

Figure 1 shows a historical chart of the United States’ NIIP (Net International Investment Position) – a measure of the difference between US-owned foreign assets and foreign-owned US assets.

Figure 1 – Rapidly Declining United States NIIP (Net International Investment Position), shows the net loss of capital. Source: FRED

Here we can see a healthy positive/neutral value was maintained until the mid 90s, and then exponential decline to today’s value of -$14 trillion. This chart is essentially tracking the transfer of capital from the United States to the rest of the world.

Shifting the focus to America's banking system, the extremely low interest rates are also causing significant stress. Historically banks have been funded using the accumulated wealth of the nation – a.k.a. the nation’s savings (or capital). However, as we have shown, America’s capital is declining, and there are no incentives for Americans to save at such low interest rates.

Simultaneously, everyone is borrowing record amounts of debt in order to leverage the capital gains. With more people borrowing and less people saving, the only way the banking system continues to function is with the federal reserve constantly expanding money supply, and the US government exponentially increasing the nation’s debt.

Unless you believe Modern Monetary Theory voodoo, this pattern of capital consumption and debt accumulation is ultimately unsustainable, because at some point the nation’s capital simply runs out, causing debts to become unserviceable.

This is the inflection point – when developed nations (including the United States) realise they have consumed too much capital, and the only way to handle the debt obligations is to print an extreme amounts of dollars – ruining the fiat monetary system.

At this point, with no capital and a severely weakened currency, the wealth and power transfer to developing nations will be complete.

Like Austin Powers, developed nations will soon realise “they stole my mojo”.

Comments